Glenn's Weekly Digest - 2/9/24

Your Weekly Guide to the Startup Universe: Navigating the World of VC & Startups for Students

Stories of the Week

Credit & Despair: Delinquency Rates Shift Into High Gear as Borrowers Brake Under Pressure

Credit card delinquencies spike, a sign of cracks in the strong consumer [Axios]

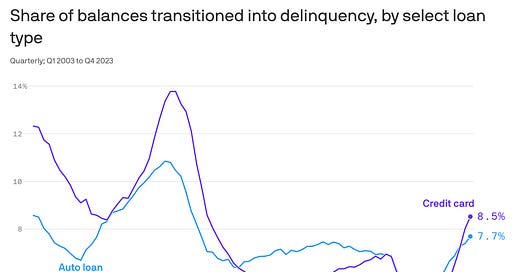

The new NY Fed report highlights a significant rise in delinquency rates for credit cards and auto loans, reaching the highest levels since the Great Recession. This increase signals financial stress particularly among younger and lower-income households, suggesting the Federal Reserve's aggressive interest rate hikes are impacting consumers' ability to manage borrowing costs.

Why it matters: The report suggests tighter credit conditions and changes in the labor market may be contributing factors to the rise in delinquencies, with recent auto loan borrowers being particularly affected due to higher vehicle prices and borrowing costs. Growing financial strain on household finances represents a rare concern for a U.S. economy that has otherwise remained resilient against challenges. This trend signals that the Federal Reserve's sharp increases in interest rates are impacting consumers, who are finding it difficult to manage the elevated borrowing costs.

Fed’s Response: The Federal Reserve has suggested that it will eventually lower interest rates, emphasizing it's a question of timing rather than possibility. However, no rate cuts are anticipated until at least the spring. To address persistent inflation, the Fed increased the federal funds rate 11 times from March 2022 through July 2023. Following its December 2023 meeting, it projected three quarter-point reductions by the end of 2024, aiming to bring the benchmark rate down to 4.6%. Although prices have begun to decrease, the Fed is looking for additional encouraging data before deciding to reduce rates.

What’s next? A recent Santander Bank survey highlighted inflation persists as the primary barrier to financial prosperity for middle-income Americans, though it also mentioned early signs of diminishing concerns over the past few months, hopefully leading to some relief for consumers. However, other research reports offered a mixed economic outlook for 2024, acknowledging the U.S. economy's resilience against a recession but raising the chance of overheating to 30%, up from 20%, which could suggest a "no landing" scenario.

Sports Streaming Re-Invents Cable

Upending TV sports, ESPN, Fox, Warner Bros. Discovery form joint streaming service [USA Today]

In a significant development for streaming television, three leading media giants have collaborated on a joint venture to provide access to all major-league sports and several additional ones. This fall, a joint package from Disney's ESPN, Fox Corp.'s Fox Sports, and Warner Bros. Discovery's TNT, TBS, and other channels will be available, featuring NFL, NBA, MLB, and NHL games.

Why this matters: This development further recognizes the fragmentation of the traditional cable bundle as an increasing number of consumers shift towards streaming services. NFL games remain at the top of Nielsen ratings, and for many years, professional sports have been crucial in maintaining the cable TV ecosystem, which has seen a reduction of over 25% in its subscriber base in recent years.

Why would the three competitors collaborate? The escalating costs of sports broadcasting rights are putting pressure on the companies, as they face declining revenues due to cord-cutting and falling ratings that reduce advertising income. Fox, Disney, and Warner Bros. Discovery recognize the critical appeal of sports television to audiences and are concerned about losing major sports rights to wealthy tech firms like Apple and Amazon. With Apple owning exclusive rights to Major League Soccer and Amazon holding the NFL's Thursday night football rights, along with being a strong candidate for a portion of the NBA's next media deal currently with Disney and Warner Bros. Discovery, this joint venture is designed to generate new revenue streams to keep these companies competitive in securing future media rights.

What does this mean for cable? This new platform acknowledges the diminishing viability of the cable bundle, which once provided a consistent revenue flow to media companies, indicating it's running out of time. Lee Berke, president of LHB Sports, Entertainment & Media, notes this move as an effort to establish new revenue sources beyond traditional pay TV. With sports and news being primary reasons people have maintained pay TV subscriptions in an era leaning towards streaming, introducing a more affordable streaming alternative for sports enthusiasts might hasten the decline in cable subscriptions, currently standing at 70 million from over 100 million a decade ago.

Top Reads This Week

Jerome Powell Interview with 60 Minutes [CBS]

In a rare interview, Scott Pelley of 60 minutes sat down with Federal Reserve Chair Jerome Powell. Powell discusses the current state of inflation, indicating it has decreased significantly over the past year but emphasizes the need for more evidence before considering rate cuts. He highlights the strong economy and labor market, expressing a cautious approach towards adjusting interest rates to ensure sustainable inflation reduction. Powell also addresses challenges like potential recessions, the national debt, and the impact of geopolitical risks on the global economy, advocating for continued American engagement in global leadership for economic stability.

How AI Will Usher in an Era of Abundance [Andreessen Horowitz]

a16z unveils their new consumer strategy and discusses the profound impact of technological advancements on human flourishing and wealth, drawing parallels between historical innovations like the plow and the microchip and the modern conveniences enjoyed today that surpass the luxuries of ancient rulers. The firm predicts that the advent of AI will usher in an "Era of Abundance," where consumers will benefit from unprecedented opportunities for creativity, productivity, connection, and personal development.

Top 5 Deals of the Week:

Mechanical Orchard, an SF-based start-up that modernizes critical legacy applications without disrupting what they’re doing, raised $24 million in Series A funding led by Emergence Capital.

Shepherd, an SF-based company that provides an all-in-one commercial

insurance platform, raised $13.5 million in Series A funding led by Costanoa Ventures.Compa, a Newport Beach based start-up that offers market data built for comp teams, raised $10 million in Series A funding led by Storm Ventures.

Finally, a Miami based company that provides an accounting and finance automation platform, raised $10 million in funding led by PeakSpan Capital.

Dexa, an NYC based start-up that offers a search engine for podcasts & videos, raised $6 million in seed funding led by Abstract Ventures.

Venture Jobs of the Week

Analyst, 137 Ventures [San Francisco]

Vice President - Impact Investing, Gates Foundation [Denver]

Global Head of Impact Investing, J&J [New Brunswick]

Analyst - Venture Investments, J&J [Cambridge]

Principal, GFT Ventures [San Francisco]

Investment Partner, M12 [San Francisco]

Managing Partner, M12 [San Francisco]

Associate, Fifth Wall [San Francisco]

Thank you for joining us for another edition of Glenn’s Weekly Digest! We hope you found valuable insights into the dynamic world of venture capital and startups. If you have any feedback or suggestions, feel free to reach out. Stay tuned for more exciting updates next week!

//

The material presented on Glenn Borok’s website and blog are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.