What’s Up With The AI Bubble

The AI boom is real but so are the distortions driving it. Here’s why the bubble might still be productive.

It’s tempting to pretend this is “normal” innovation exuberance. It isn’t. We’re living through a capital-markets experiment where compute is the commodity, CapEx is the product, and revenue is the promissory note. That doesn’t make it doomed - it just means we should describe the thing honestly.

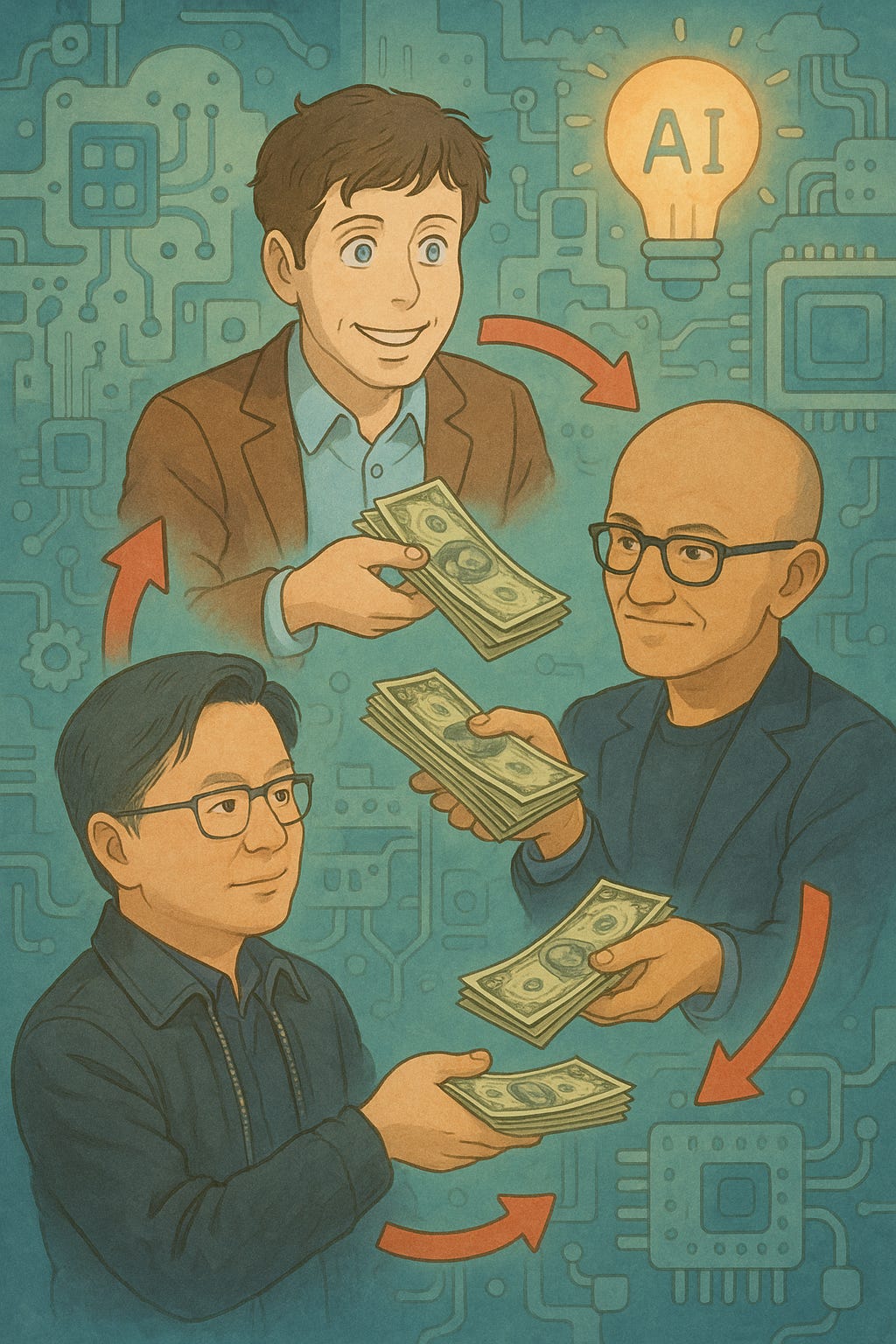

The clearest tell is the spiral of “I buy your chips, you buy my software, we each book growth” deals. OpenAI’s fresh $38 billion agreement to run on AWS is the latest turn of the flywheel, diversifying beyond Microsoft and reinforcing Amazon’s AI-infra story at the same time.1

Zoom out and the structure matters more than any single press release: hyperscalers pre-order silicon and power, model companies pre-order capacity, and everyone points to the other party as future demand. The Wall Street Journal’s framing of these “circular” arrangements is right on the nose - virtuous on the way up, vicious on the way down.2

The vibe shifted this week when Brad Gerstner asked Sam Altman the obvious question: how do you square trillion-scale spend commitments with tens of billions of revenue?

Altman bristled: “If you want to sell your shares, I’ll find you a buyer… Enough.” That defensiveness is notable precisely because OpenAI has been winning. Great companies usually welcome the hard questions.3

Too big to fail, tech edition

Another WSJ piece argues that Altman has so successfully entangled OpenAI with the platforms and suppliers that the firm now sits at the nexus of a “vital part of the U.S. economy.”

That’s a polite way of naming systemic risk: if the center stumbles, the shock propagates through clouds, chip roadmaps, and the lenders backstopping data-center buildouts. We’ve seen this movie in finance. Tech is writing a remake.4

Independent analysts estimate OpenAI needs something like hundreds of billions of dollars up front to keep timelines on these mega-builds. Even if you haircut the blog-headline “$400 B in the next 12 months,” the underlying point stands: these projects require enormous committed equity and debt before revenue shows up. That gap must be bridged somehow.5

That risk isn’t theoretical anymore. At the WSJ’s Tech Live conference, OpenAI CFO Sarah Friar said the company is exploring a financing ecosystem that could include banks, private equity, and even a federal “backstop” or “guarantee” to support its massive chip investments. She later clarified on LinkedIn that she’d “muddied the point” - not that OpenAI wants a bailout, but that building national-scale compute will require both public and private capital. Still, the subtext was clear: OpenAI is already thinking in systemic terms.

What breaks and what endures

Here’s my read on where the rubber meets the road:

Financing-stack stress – If circular deals slow, the weakest links aren’t GPUs or models but the financing vehicles that assumed infinite utilization.

Watch private-credit funds and structured leases tied to specific data-center phases.The utilization trap – Hyperscalers can carry short-term under-utilization. Startups can’t. If model companies can’t push enough paid inference to match fixed commitments, the problem compounds quarter by quarter.

Regulatory backstop risk – “Too big to fail” talk invites scrutiny.

If policymakers perceive systemic risk in AI infra, expect capital controls in disguise: siting, interconnect, and power-allocation approvals that slow the cycle right when CFOs most need speed.Second-order demand – Productivity gains are real, but broad willingness to pay remains the bottleneck. Enterprises will pay for agents that own outcomes, not tokens burned. Until then, CapEx is running ahead of product-market-pricing.

Bubbles allocate resources at historic speed. Railroads, canals, fiber, and dot-coms all overbuilt. When they popped, the assets didn’t vanish. The equity got wiped, the debt got repriced, and the physical substrate powered the next decade. If you believe AI will be a general-purpose technology, you almost want irrational infra build-out… you just don’t want to be the one holding the paper when the music stops.

My working thesis

Yes, this is a bubble – The scale and pace of commitments relative to present cash flow is textbook. The circularity between buyers and sellers is the tell.2

It is also productive – The AWS-OpenAI deal, and its cousins, are compressing ten years of infra build into three. That accelerates learning curves and drops unit costs faster than a “rational” market would.1

The physical legacy will outlast the chip cycle – GPUs age fast; five years is a generous lifecycle before the next architecture leap makes today’s clusters obsolete. But the power and cooling capacity being built to feed them - substations, transmission lines, water and heat-recovery systems - last decades. That’s the paradox most investors miss: even if AI hardware demand collapses, the energy infrastructure underneath becomes a lasting public good. Every earnings call now cites power scarcity as the gating factor, not compute supply. If the bubble forces an overbuild in generation and grid modernization, history may remember it as the most productive overreaction of the decade.

Outcome bifurcation – If product monetization lags, equity takes the hit and the compute substrate gets marked down for the next wave. If monetization catches up, hyperscalers win big and model providers consolidate to a few with durable, high-margin platforms. Either way, the hardware and power get built.

Watch the tone, not just the numbers – CEO temperament is a late-cycle indicator. When the market asks basic questions and leadership answers with bravado, that’s usually the prelude to a price-discovery phase.3

What to watch next

Deal-structure drift – More revenue guarantees or make-whole clauses suggest counterparties are already pricing in demand risk.2

News cadence on mega-CapEx – If the run rate of multi-tens-of-billions announcements slows or shifts toward deferrals, you’ll see it in Reuters and WSJ headlines first.1

Net-net: I’m pro-infrastructure and skeptical of story stocks. The AI bubble will almost certainly pop in asset prices before it pops in real-world utility. For builders, the mandate is simple: ship products that own outcomes and create defensible willingness to pay. For investors, underwrite utilization, not vibes. For everyone else, remember - the most durable returns in bubbles accrue to the people who survive them.

//

Reuters – “OpenAI, Amazon strike $38 billion agreement for ChatGPT-maker to use AWS” (Nov 3 2025) https://www.reuters.com/business/retail-consumer/openai-amazon-strike-38-billion-agreement-chatgpt-maker-use-aws-2025-11-03/

Wall Street Journal – “Is the flurry of circular AI deals a win-win—or a sign of a bubble?” https://www.wsj.com/tech/ai/is-the-flurry-of-circular-ai-deals-a-win-winor-sign-of-a-bubble-8a2d70c5

Brad Gerstner Podcast exchange with Sam Altman, transcript summary via multiple outlets (Nov 2025).

Wall Street Journal – “Is OpenAI Becoming Too Big to Fail?”

https://www.wsj.com/tech/ai/is-openai-becoming-too-big-to-fail-400bac2cWhere’s Your ED At – “OpenAI Needs $400 B in the Next 12 Months”

https://www.wheresyoured.at/openai400bn/